Archives for April 2016

TO CUT OUR PROPERTY TAXES, FIX ROCKY’S MISTAKE

Via Albany Times-Union

In 1965 President Johnson and Congress enacted the federal-state Medicaid program to provide health care for the poor. Soon after, New York Governor Nelson Rockefeller adopted the program but made a critical mistake which has haunted property taxpayers for over 50 years. The mistake was to impose half of the state’s share of Medicaid on county governments and New York City.

In typical New York fashion, Medicaid was especially generous. Albany’s generosity was made easier because the counties – and their property taxpayers – were required to foot half of the local cost. This arrangement has greatly contributed to the astronomical cost of Medicaid in New York. With eight percent of the nation’s population, our program now accounts for 15 percent of total nationwide spending.

Albany’s cost shift can be explained another way. Imagine if you could lease a $500 luxury car knowing that you could afford the payments because you could make someone else pay $200 of the monthly cost? Well, that is just what state government has been doing to counties for 50 years – passing along Medicaid costs to residential and business property taxpayers. The result? Property values drop and business investment in job-creating enterprises is discouraged.

Despite capping cost increases in recent years, local governments in New York spend more on Medicaid than localities in the other 49 states combined. While federal law permits such cost-sharing, only New York has taken it to such extremes.

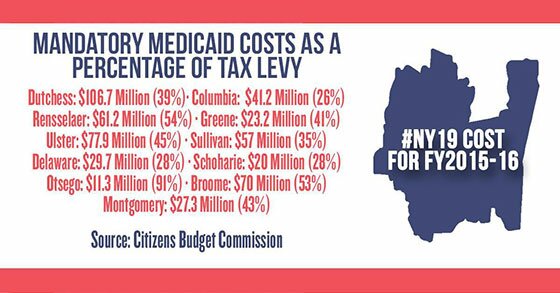

This cost-sharing with counties is a major reason why county property taxes are so high in New York. For instance, Rensselaer County in 2015 devoted 54 percent of its entire $61.2 million property tax levy to the program. In Otsego County, over 90 percent of their county property tax goes to foot the Medicaid bill. This is killing county property taxpayers across our state and it is time we fix it. Unfortunately, fixing Medicaid financing is not on Governor Cuomo’s agenda.

Since Albany won’t act, Congress should. Federal law should be amended to eliminate the local government share of Medicaid within a five-year period. This change would largely affect only the Empire State and it should also be given additional program flexibility to reform its program and absorb local costs over a five-year period.

Upstate New York continues to lose population and jobs as people flee to other states. According to Census figures, 38 of the 50 Upstate counties lost population between 2000 and 2014. For all the happy talk and taxpayer-funded TV commercials announcing New York’s economic recovery, the reality of people voting with their feet tells a different story.

If we are going to truly reverse Upstate New York’s decline, we must cut property taxes. Getting the Medicaid burden off the backs of residential and business property taxpayers is necessary to lower the cost of living here. Fixing Governor Rockefeller’s 50-year-old mistake is a critical step in correcting what ails Upstate New York.

John Faso is former Republican leader of the state Assembly and candidate for Congress in the 19th Congressional district. To learn more about Faso, visit johnfaso.com.

Faso Releases ‘Better Off’

Television Ad Focuses on Fixing Economy, Helping Small Business

Kinderhook, NY April 13, 2016… John Faso,the endorsed Conservative, Republican, Independent candidate running for Congress in the 19th Congressional District,today released his second television advertisement, which focuses on his plans to turn the Upstate economy around and help small businesses.

Called “Better Off,” the 30second spot will air on cable television and digital outlets throughout the district in conjunction with a previously released advertisement called “Challenge.” It outlines his key reform principles in helping small businesses such as simplifying the tax code, ending corporate welfare, investing in small businesses and ending regulatory madness.

“President Obama doesn’t get it, you can’t fix a problem if you keep ignoring it,” Faso says.

View “Better Off” here.

Script below:

President Obama: ‘By almost every economic measure, we are significantly better off.’ John Faso: Tell that to the family struggling in Kingston.

Or the small business in the Catskills scraping to make payroll. I’m John Faso, my plan to get the economy growing again would:

- Simplify the tax code

- End corporate welfare

- Promote small business investment

- And end Washington’s regulatory madness

President Obama doesn’t get it, you can’t fix a problem if you keep ignoring it. I’m John Faso, and I approve this message.

Faso’s previous advertisement focused on his record in the Assembly, which includes closing a $5 billion deficit and championing property tax reforms such as the STAR program that affects tens of thousands of families, and assures residents that he is ready to take on the challenges in Washington.

View the “Challenge” ad here.

Both segments are aimed at distinguishing Faso from the rest of the field and will be aired leading up to the June 28 primary.

Faso is running to fill the seat now held by Congressman Chris Gibson (R), who is not seeking reelection. As a member of the New York Assembly, Faso developed and pushed proposals that led to real balanced budgets including the first reduction in state spending in decades while closing a $5 billion deficit. He championed legislation that made a difference for tens of thousands of families such as the STAR program and education and real property tax reform. A former board member of the Rockefeller Institute of Government, Faso also served for three years as a member of the Control Board that worked to fix the financial and managerial issues of the City of Buffalo and its school system.

Mr. Faso and his wife, Mary Frances, a registered nurse, are the proud parents of two children. They have lived in Kinderhook, New York, for more than three decades.

John Faso (R-Kinderhook) is former Republican leader of the state Assembly and candidate for Congress in the 19th Congressional district. To learn more about Faso, visit johnfaso.com.

Johns Interview with Susan Arbetter

Listen to John’s interview about the important issues facing #NY19!

John Faso’s Interview With Fred Dicker

got high taxes? ban the medicaid mandate.

Faso's Reform Plan to Cut Property Taxes

Federal Plan Would Remove Albany's Medicaid Burden on Local Taxpayers

Kinderhook, NY — April 5, 2016 … Citing New York's outrageous property taxes as a major cause of Upstate's economic decline, Congressional candidate John Faso (R-Kinderhook) today announced that, if elected, he will introduce legislation amending federal law (42 USC 1396a)to eliminate a state's ability to impose a local government share of Medicaid costs. Among the 50 states, New York requires a disproportionate share of Medicaid costs to be borne by county governments and the City of New York. In fact, New York localities pay more Medicaid costs – $7.5 billion in SFY 2013-14 – than local governments in the other 49 states combined.

In releasing his plan, Faso – who as a member of the Assembly cut spending and championed proposals that led to real balanced budgets – called it a smart way to reduce costs, increase efficiencies and align New York with most other states in the nation that don't pass their Medicaid expenses down to county taxpayers.

"Property taxes are killing New Yorkers. Federal law allows states to impose a portion of the state share of Medicaid costs on local governments. New York State imposes the highest burden in the nation on property taxpayers for support of Medicaid. It's wrong and my proposed legislation will result in major reductions in county property taxes throughout the state. In the 19th Congressional District, property taxpayers – both residential and commercial – paid approximately $224 million in 2015 in Medicaid expenses. High property taxes also depress home values and adversely affect business location decisions.

"When people wonder why their property taxes are so high compared to other states, the mandated local share of Medicaid is a primary reason," said Faso. "My proposal will fix this problem and force Albany to finally reform its Medicaid system while allowing significant property tax cuts for homeowners. We can't continue to require homeowners to shoulder costs which the state should be paying."

New York State has the largest Medicaid program in the nation. New York with approximately 8% of the nation's population, is responsible for around 15% of total national Medicaid spending. The state spends more than $54 billion on the health care program for the poor, which exceeds total spending in the states of Florida and Texas combined, according to the Kaiser Family Foundation. While some other states require localities to foot a small part of the Medicaid bill, local governments in New York State pay more in Medicaid costs than localities in the other 49 states combined.

Because the local share of Medicaid is mandated by Albany, state government has adopted the most generous program in the nation without being responsible for footing the entire non-federal share of the Medicaid system. Dutchess County, for example, is expected to spend nearly 40 percent of its $106.7 million property tax levy on Medicaid in 2016. Other counties in the 19th district pay remarkably high percentages as well: In 2015, roughly 95 percent of Otsego County's tax levy went to cover its Medicaid costs; over half of Rensselaer's levy consisted of Medicaid payments and in Schoharie County it approached 28 percent.

As proposed by Faso, the plan would be phased in over a five-year period affording state government the opportunity to plan for a full takeover of local Medicaid costs. New York should also be given additional program flexibility to allow it to absorb local costs.

"If the burden of Medicaid were lifted off the backs of our county property taxpayers we could cut every homeowner and businesses' property taxes by 54%," said Rensselaer County Executive Kathy Jimino. "Unfortunately our state leaders have refused to do what the majority of other states do and pay for their own share of the Medicaid bill. By making this a legislative priority, John Faso, who has long been known as a creative and innovative legislator, demonstrates his commitment to providing meaningful relief to the taxpayers of this state. John provides exactly the type of thinking we need in Washington to bring about the tax relief our families and businesses need and deserve."

"John Faso's idea would finally end the inequitable system – in place for 50 years since the Rockefeller Administration – which has county governments and the City of New York paying for a local share of Medicaid benefits mandated by Albany," said William Cherry, Schoharie County Treasurer. "It is high time this system ended and the Faso plan is an ingenious approach to solve a problem which has long burdened county taxpayers. County governments have to raise the taxes to pay for a program that is controlled by state government in Albany. The Faso plan fixes this unfair situation."

|

County |

2015 Tax Levy |

2015 Medicaid Expenses |

Percent of Taxes |

| Dutchess | $106.7 million | $41.7 million | 39 percent |

| Otsego | $11.3 million | $10.3 million | 91 percent |

| Schoharie | $20 million | $5.6 million | 28 percent |

| Greene | $23.2 million | $9.5 million | 41 percent |

| Ulster | $77.9 million | $35.3 million | 45 percent |

| Sullivan | $57 million | $19.9 million | 35 percent |

| Columbia | $41.2 million | $10.8 million | 26 percent |

| Delaware | $29.7 million | $8.4 million | 28 percent |

| Montgomery | $27.3 million | $11.8 million | 43 percent |

| Rensselaer | $61.2 million | $33.3 million | 54 percent |

| Broome | $70 million | $37.4 million | 53 percent |

|

Total |

$525.5 million |

$224 million |

42 percent |

Faso is running to fill the seat now held by Congressman Chris Gibson (R), who is not seeking re-election. As a member of the New York Assembly, Faso developed and pushed proposals that led to real balanced budgets – including the first reduction in state spending in decades while closing a $5 billion deficit. He championed legislation that made a difference for tens of thousands of families such as the STAR program and education and real property tax reform. A former board member of the Rockefeller Institute of Government, Faso also served for three years as a member of the Control Board that worked to fix the financial and managerial issues of the City of Buffalo and its school system.

Mr. Faso and his wife, Mary Frances, a registered nurse, are the proud parents of two children. They have lived in Kinderhook, New York, for more than three decades.

John Faso (R-Kinderhook) is former Republican leader of the state Assembly and candidate for Congress in the 19th Congressional district. To learn more about Faso, visit johnfaso.com.

###